Loans and credit too tight? “Cash in” Old Tax Returns Instead

Operate a C-Corporation? Own real estate? Make investments? Pay payroll taxes? Los Angeles CPA Emil Estafanous uses his accounting skills to review a taxpayer’s 5 past years of returns, restructure income and expenses, and refile the return to get a tax refund. Says one business-owner client: “It was like getting a $74,928 loan – only I never have to pay it back.”

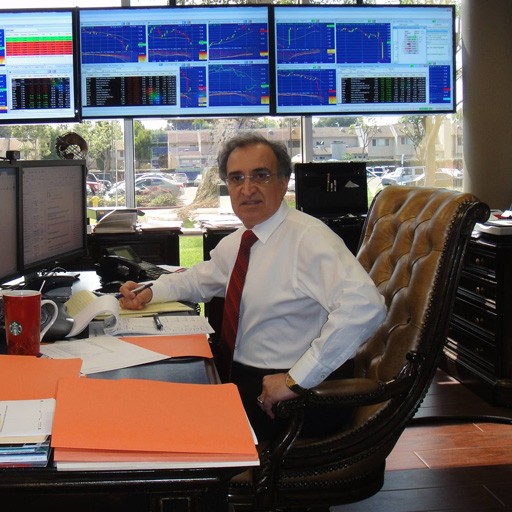

Norwalk, CA (PRWEB) October 8, 2009 — Like many Los Angeles-area CPAs, Emil Estafanous is an expert on current IRS and state tax law. But unlike many of his peers, Estafanous has built his reputation as The Refund Guru by looking backwards -helping clients revisit and refile past tax returns to recoup tens of thousands of dollars. In fact, since 2003, he has won refunds for clients that total more than $1,000,000.

“It’s more than minimizing taxes,” says Estafanous, “I want to get the numbers down to where my clients actually get refunds. That’s why the first thing I do with new clients is look back at five past years of returns. I am almost always able to spot where they have overpaid — sometimes double paid — their Federal and state taxes. In these cases, I refile those old returns and my clients get refund checks.”

Some of those refunds have been huge: One Los Angeles-area business owner says that by restructuring several areas of her old tax returns (including rental income), Estafanous was able to win her a refund of $74,928 in Federal and state taxes. That’s an important infusion of cash, particularly in an economy where both businesses and individuals are finding both cash flow and credit hard to come by.

From past-year refunds to daily accounting.

Clients value the personal interest Estafanous takes in them. One client notes that in addition to tax preparation, Estafanous handles his payroll. In doing so, the CPA assures smooth operations and tax compliance and has slashed payroll taxes through restructuring. Another business client uses his BlackBerry to check with Estafanous on the go about everything from purchases to investments.

Estafanous’ approach even rewards clients with IRS or audit problems.

One equipment company owed substantial payroll taxes. When Estafanous looked closer, however, the CPA saw the business was losing money, the owner was using a line of credit to pay himself, and rent for the office building wasn’t properly categorized or charged. Estafanous shaved $60,000 from the tax bill.

Estafanous is also known for empowering investors – especially futures traders – to minimize tax hits. In one instance, he was able to restructure $400,000 of gains into tax-deferred retirement savings.

A free offer from a CPA with his own “recovery plan.”

“In this economy,” Estafanous says, “I am very much on a mission to help my clients hang onto their businesses – and their dreams.” That’s why the accounting firm makes this free offer to everyone: Estafanous will look at five past years of tax returns. Taxpayers can blank out any personal information, account numbers, etc. All Estafanous needs to see are the numbers to tell taxpayers how big a refund could be gotten and what the accountant’s fee would be. There’s no charge for having Estafanous look at the returns. If a taxpayer decides to go after the refund, Estafanous will refile the return, and the taxpayer will receive the refund check.